By Yamila Levalle, Security Researcher at Dreamlab Technologies

Metaverse real estate are parcels of land in virtual worlds. They are pixels in the most basic sense. However, they are more than just digital images.

They are programmable spaces in virtual reality platforms where users can interact socially, play games, buy and sell NFTs or other virtual merchandise, attend meetings or virtual concerts, and carry out a wide variety of virtual activities.

Virtual real estate is a unique area of land, with a deed of ownership, but situated in a digital world. These worlds are often compared to video games, although including more social and community components. Land in the metaverse, the collection of virtual worlds where buying virtual land is possible, can be as valuable as a piece of land in the real world. The following image shows virtual real estate offered for sale in one such metaverse world ‘The Sandbox’:

Source: sandbox.game

With the rise of the metaverse, digital real estate is expected to grow and expand as well. In fact, there was a metaverse real estate boom in the last quarter of 2021 after Facebook changed its name to META and indicated a focused interest in the metaverse.

Why Purchase Land in the Metaverse

Metaverse real estate provides users with a place to connect with other people online. Individuals can use their digitised land to play games and socialise. Creators can monetise the content of their property by charging for access or trading their NFTs. Brands can organise virtual product launches, advertise their services, and offer exclusive customer experiences using their virtual properties.

For real estate investors, these parcels of digitised land can offer a lucrative opportunity. Metaverse properties are built, flipped, or leased just like real-world ones. This offers a wide range of potential applications for metaverse real estate.

Plots of land in the virtual real estate market may seem like unusual investments. However, they are very similar to real-world real estate in many ways. Two factors in particular make them particularly interesting to investors:

- First, just like in the real world, there is a limited supply of virtual property. Owning virtual real estate entitles you to a unique parcel of land in the metaverse, that as previously described, can be used for a variety of purposes.

- Secondly, each parcel of metaverse real estate is wholly unique. While blockchain-based real estate in the metaverse may not be physical, it offers the same – or perhaps even stronger – ownership rights over a plot of digital land. Land ownership in a game, community, or other platform is represented by an NFT. As NFTs are non-fungible (i.e., each one is unique) and can securely prove digital ownership, they act much like property deeds in digital real estate. An NFT can be traded, bought, and sold according to its market value, which is derived from a range of factors.

Large brands experimenting with metaverse real estate include:

- HSBC: Purchased a piece of land in ‘The Sandbox’ in the first quarter of 2022 with a plan to create new brand experiences.

- Samsung: Created a virtual experience called Samsung 837X in ‘Decentraland’ and hosted events such as the #RecycleUp Fashion Show.

- The South China Morning Post: Developed a digital version of the Hong Kong Star Ferry Pier in ‘The Sandbox’.

Where Can I Find Virtual Land for Sale?

Before digging into more of the detail, itвАЩs worth keeping in mind that most platforms have a limited amount of parcels available. This helps boost digital scarcity and fuel a healthy virtual economy.

‘Decentraland’, for example, is divided into 90,601 individual plots of virtual land of equal size, while ‘The Sandbox’ is made up of 166,464 plots, which the platform calls LANDS. However, there are many other options available, each offering territories suitable for all types of activities, like advertising, business, services and events.

Top metaverses include:

- The Sandbox: As touched upon above, lots on ‘The Sandbox’ are marked as LAND and they can be found either through ‘The Sandbox’ platform or be purchased second-hand on some third-party NFT exchange, such as ‘OpenSea’ and ‘Rarible’. From ‘The Sandbox”s 166,464 plots of LANDs, the public will be able to purchase 123,840 (74%) of the total tokens. The remainder will be offered as rewards to gamers, creators, or partners (16%) or kept by ‘The Sandbox’ for their use (10%).

- Decentraland: Land in this metaverse has ranked at the top of most expensive sales, with plots going for millions. A major part of the allure of ‘Decentraland’ is related to the platform’s high profile partnerships with brands, along with its celebrity and influencer tenants. In total, the platform offers its users 90,601 lands, each of which currently covers square spaces measuring 16 metres x 16 metres (previously it was only 10 metres x 10 metres). The lands are further classified into 33,886 districts, 9,438 streets and 3,588 plazas.

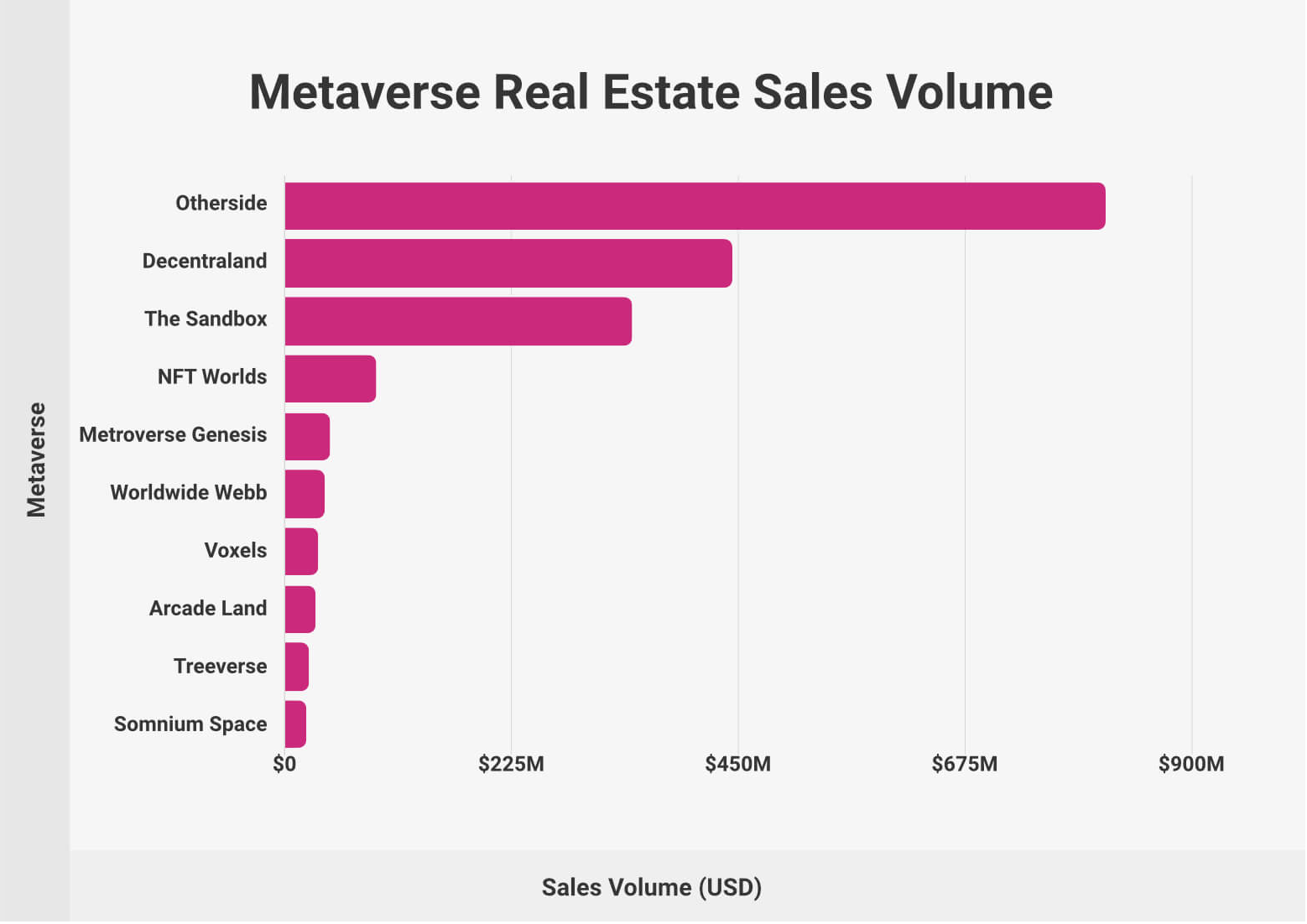

- Otherside: The Otherside Metaverse is a 3D virtual world based on the BAYC project. It is an MMORPG (Massively Multiplayer Online Role-Playing Game) where, according to the project team, up to 10,000 players can simultaneously interact and voice chat with each other. The team behind the Otherside project launched around 55,000 parcels of virtual land in its public sale debut.

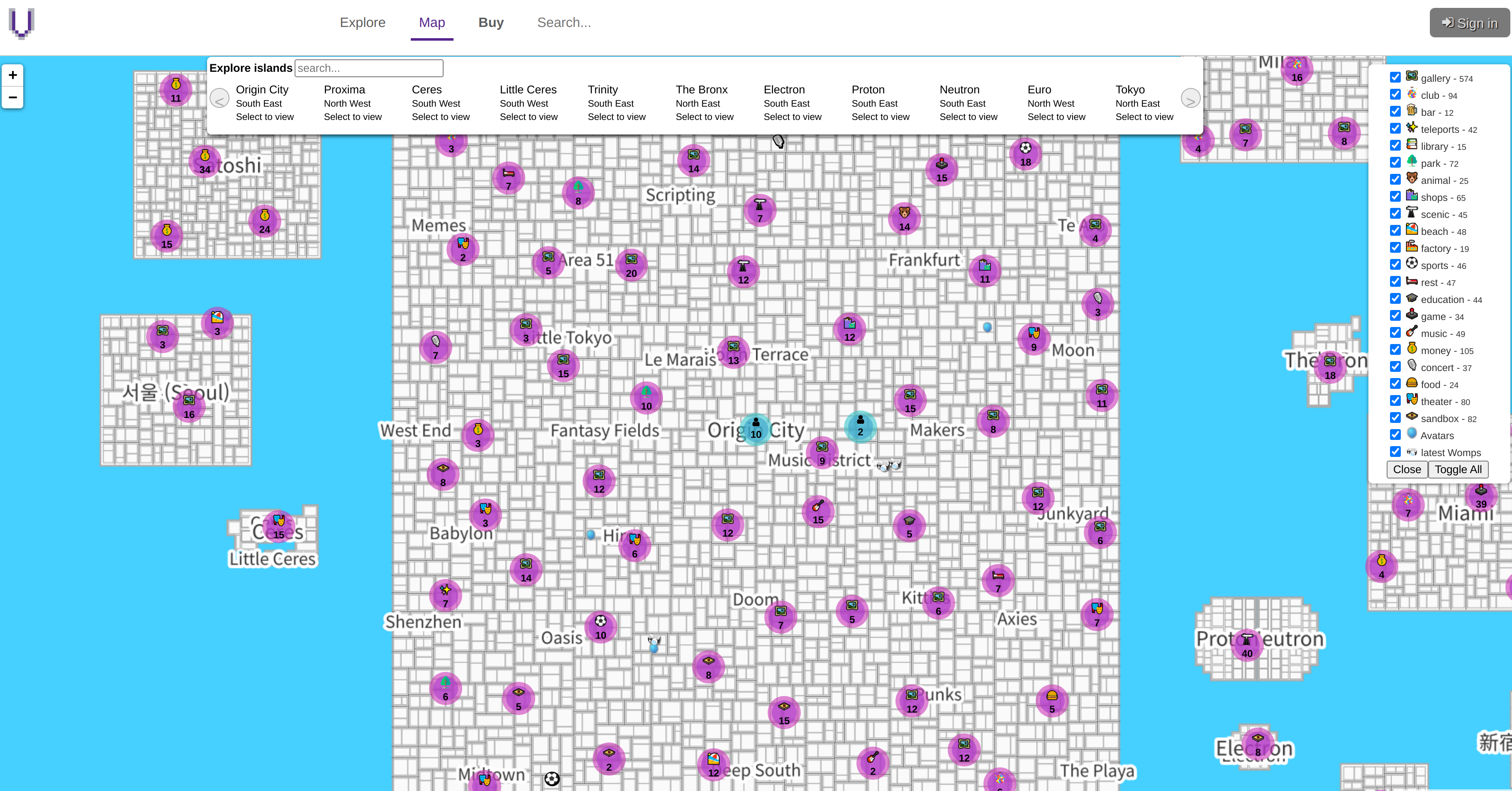

- Voxels: This digital world ranks amongst the smallest, originally consisting of just 3,026 parcels. However unlike other metaverses, ‘Voxels’ has kept expanding and currently features 8,555 parcels. They can be bought through primary sales or via ‘OpenSea’, in exchange for both USD and ETH.

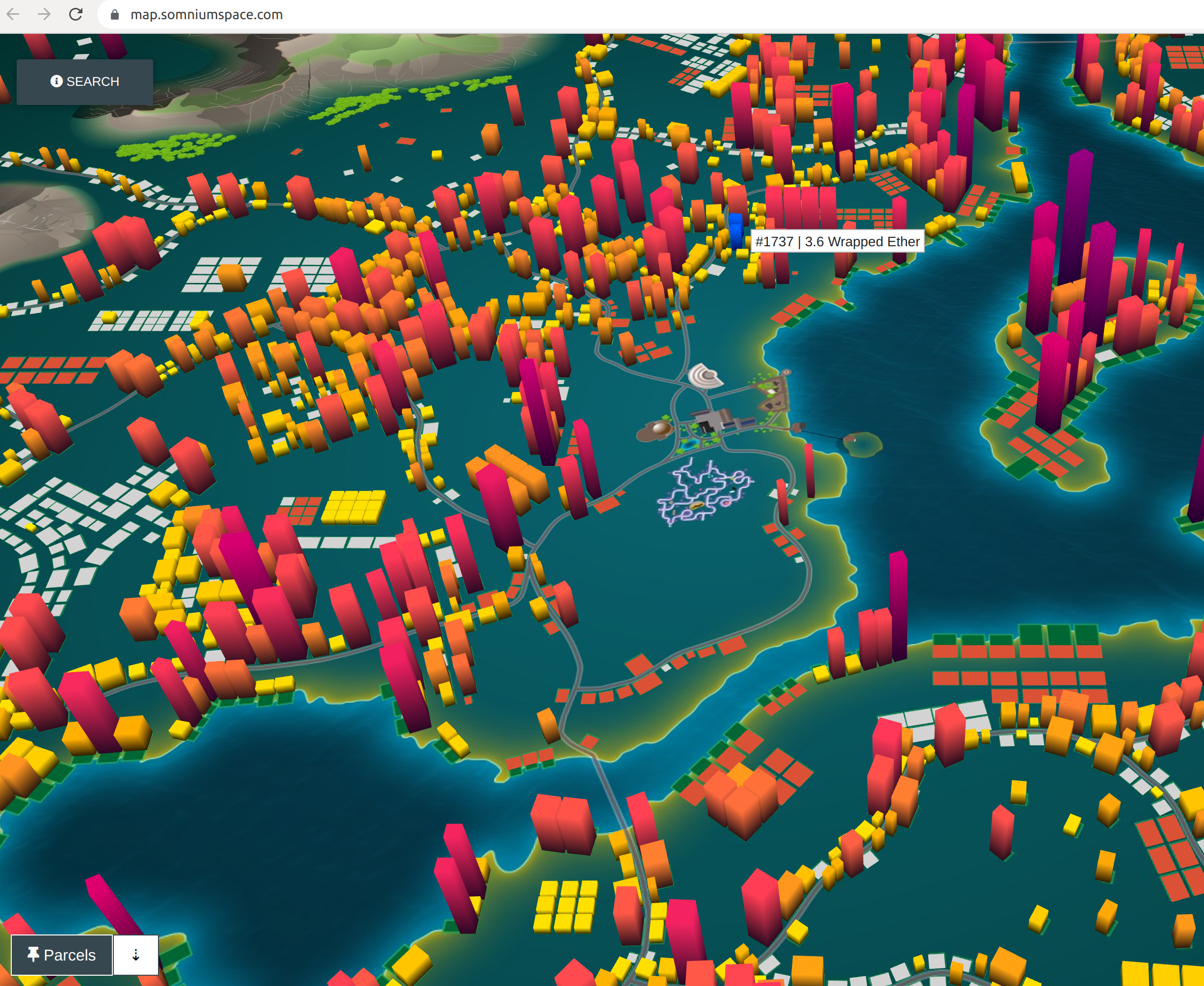

- Somnium Space: This metaverse was launched in 2018, with a heavy focus on virtual reality offerings and is particularly known for its games and NFT art. Currently there are 5,026 unevenly divided land parcels in the platform. However, more land is expected to be released in the future. The currency of ‘Somnium Space’ is $CUBE and plots of land can easily be found on ‘OpenSea’.

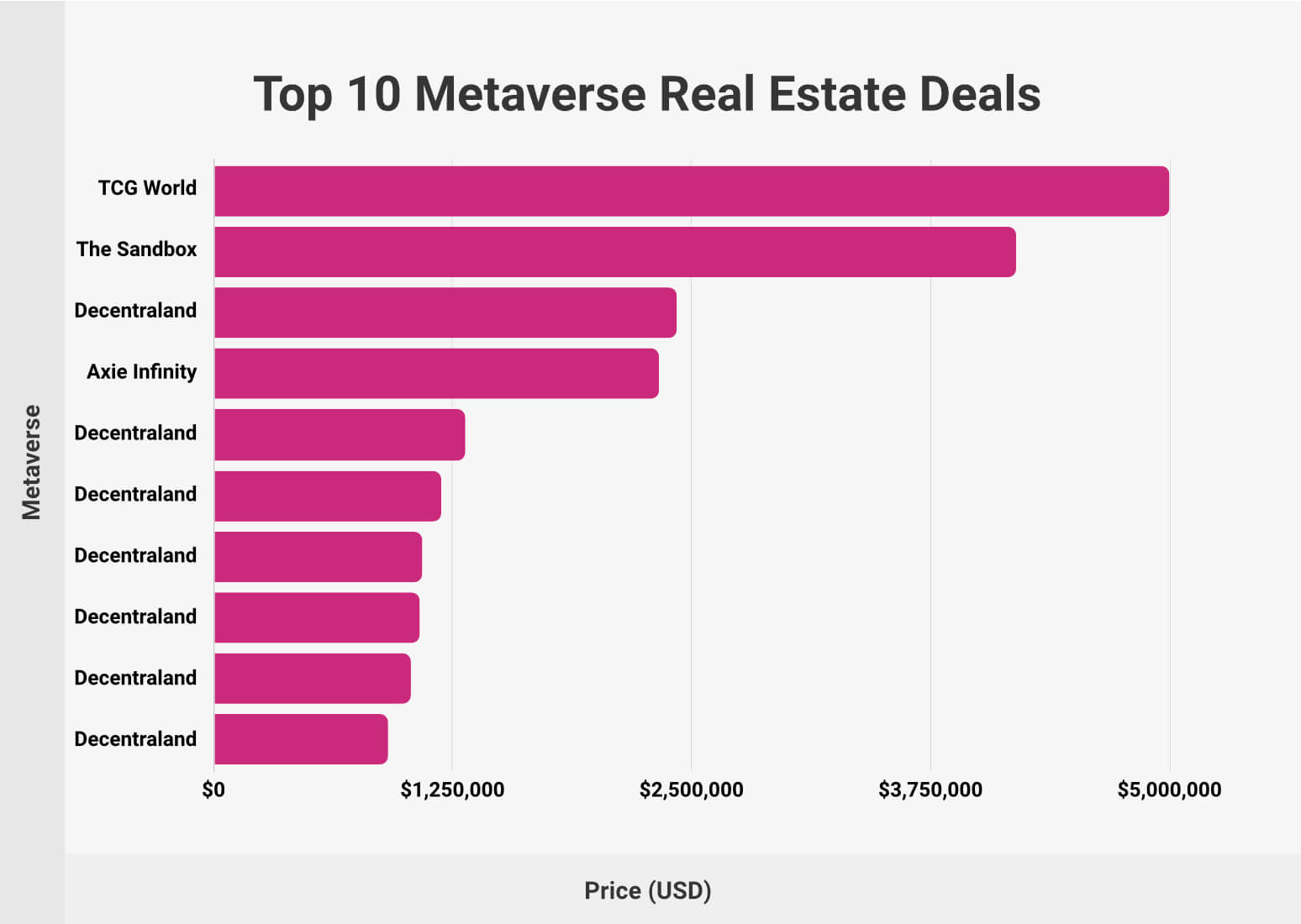

- TCG World: TCG Gaming developed TCG World, a large NFT based virtual gaming experience where people can earn real money, work, play and socialise. TCG World consists of 100,000 user-owned plots of virtual land, each sold in the form of NFTs.

Source: https://map.somniumspace.com/

Source: https://www.voxels.com/map

What affects the price of Virtual Land?

The market value of a virtual property is derived from a range of factors. A particular metaverse real estate might be in a popular area with lots of digital foot traffic, making it suitable as advertising space. Staking benefits and other utilities also boost the value of the land. The specific metaverse platform will also will determine the land value. Some metaverse platforms allow for a considerable degree of personalisation, making it easier to build a unique space and plan exclusive events, and experiences. Examples include ‘The Snoopverse’ on ‘The Sandbox’ and Netflix’s content on ‘Decentraland’. Let’s dive further into the three key factors that determine virtual land price:

- Utility: Each metaverse platform, game, or universe has a defined utility for its virtual real estate. Some allow for high levels of customisation, while others provide greater in-game benefits or stat boosts. An NFT virtual land with a particularly desirable utility, will be able to command a higher price on the open market.

- Platform: As mentioned above, the platform hosting the land will define its utility. Beyond that, a platform’s brand name and reputation will also influence the value of a specific NFT land. This is akin to Nike or Adidas being able to charge considerably more than a lesser-known brand with comparable product quality.

- Speculation: The idea that an area of metaverse real estate may be more valuable in future is often enough to affect its price. If the whole market shares this sentiment and is bullish on metaverse land price, speculation becomes a significant factor in determining price.

When ‘Decentraland’ held its first LAND auction at the Terraform Event in December 2017, a parcel of land cost a mere $20. Those parcels sold for an average of over $6,000 in 2021. With the positive outlook on metaverse growth, companies have been heavily investing in virtual land properties. In October 2021, Tokens.com, a blockchain technology company, acquired 50% of virtual real estate company Metaverse Group for $1.7 million. In November, the Republic Realm broke records when it purchased a property in ‘The Sandbox’ for a whopping price of $4.3 million. One of the biggest sales the past year is a property adjacent to Snoop DoggвАЩs in ‘The Sandbox’. An anonymous buyer having purportedly bought it for $450,000. For such a young industry, the numbers can be staggering. However, rapid growth in market capitalisation isn’t necessarily correlated with longevity or a healthy market.

In 2022, metaverse land price, total sales and trading volume dropped significantly. The average price of land was $16,300 in February 2022 and fell to $3,300 in June 2022, down nearly 80%. Trading volume topped out with $229 million in November 2021 to $8 million in June 2022, for a 97% decrease and total sales went from 16,000 in November to 2,000 in June, a drop of 88%.

Risks and Challenges of Investing in the Metaverse

As with any other emerging technology, there are risks and rewards associated with any investment being considered. Certainly, metaverse land (and the lack of tangible assets) might seem like a mind boggling concept to many, but the potential of virtual worlds as well as adjacent technologies like virtual and augmented reality, and artificial intelligence can hardly be disputed. Only time will tell whether the metaverse is just another speculative investment filled with overpriced digital properties, or if virtual worlds are the future of the internet.

- Investing in the metaverse is promising, but it can also pose high risk owing to its relative newness. Although researchers predict that the metaverse has an excellent scope for growth, it is still a relatively new industry that is far from stable and it is very early to predict how the industry will grow. For instance, if a metaverse platform decides to go offline permanently, all associated land and assets in that platform vanish.

- The valuation of physical land appreciate or depreciate based on market conditions, environment, and other tangible factors. But, all these factors have no impact on metaverse real estate since the virtual environment can be tightly controlled. There will always be questions about how to assign value to a land whose scarcity is artificial and whose future value cannot be quantified. With their value dependent on highly volatile cryptocurrencies, metaverse land is susceptible to volatile conditions as well.

The virtual world’s uncertainties can grow exponentially to produce enormous benefits or deteriorate into a complete loss of investments. Fully research the metaverse before making any investment decisions. Consider all the risks and challenges, then weigh them with the potential advantages. Only after determining your specific level of risk tolerance, spoken with metaverse experts, carefully considered all of your investment options, and thoroughly examined all of the benefits and disadvantages should any decision be made about investing in metaverse real estate.

Conclusion

The long-term adoption of metaverse real estate is beyond the hype: based on real use cases and utility to succeed, it’s amazing to see the progress metaverse real estate has made in such a short time. The maturity of the metaverse will possibly increase along with its popularity and perhaps the price drop seen this year can be seen as an opportunity to enter the market, but we must always keep in mind that the future of virtual real estate is unknowable and, therefore risky. Becoming familiar with digital property is a good idea for any potential user, company or investor who is interested in the future of the metaverse.

Looking for a Smart Contract audit service? We can help you!

Feel free to contact us for more information.

References and Useful Links:

- https://academy.binance.com/en/articles/what-is-metaverse-real-estate

- https://influencermarketinghub.com/metaverse-virtual-real-estate/

- https://www.fool.com/investing/stock-market/market-sectors/information-technology/metaverse-stocks/buying-virtual-land/

- https://sensoriumxr.com/articles/buying-land-metaverse

- https://parametric-architecture.com/everything-you-should-know-about-the-metaverse-real-estate/

- https://qulture.agency/thought-leadership/buy-rent-or-punt-what-brands-need-to-know-about-virtual-land

- https://www.rubyhome.com/blog/metaverse-real-estate-stats/